How to Find Annuity Clients: 5X ROI Methods

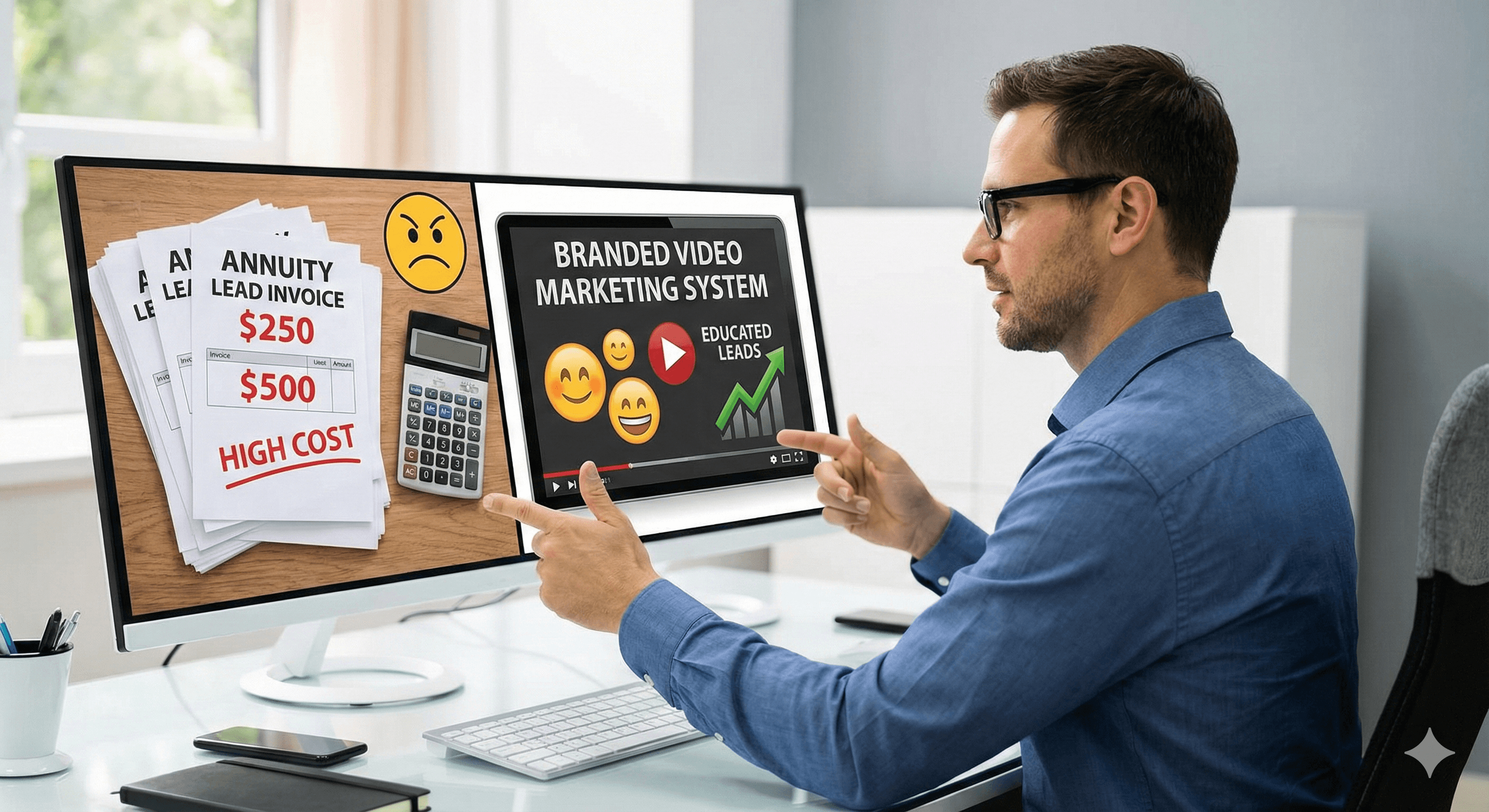

You're spending $250-$500 per annuity lead. Your close rate is 2-5%. You're losing $5,000-$25,000 per sale. Meanwhile, top producers find annuity clients for $50-$100 each with 15-25% close rates. The difference isn't experience. It's strategy.

Finding annuity clients means identifying prospects ages 45-65 with retirement savings who need guaranteed income. The most effective method is branded lead generation: creating educational video content that prospects consume before booking appointments. This pre-education eliminates the 30-45 minute education gap that kills traditional lead conversion. Branded methods deliver 15-25% close rates and $200-$667 cost-per-sale versus 2-5% close rates and $5,000-$25,000 cost-per-sale for cold lead buying.

The math exposes the problem: buying leads burns cash. Generating branded leads builds assets.

The $25,000 Problem: Why Traditional Methods Fail

Most advisors find annuity clients using methods that look cheap but cost 10-50x more in reality.

The Cold Lead Buying Trap

You buy 20 annuity leads at $300 each. Total: $6,000.

What happens:

- Contact rate: 25-35% answer. You reach 6-7 people.

- Education time: Each needs 30-45 minutes of annuity education. You spend 3-5 hours.

- Qualification rate: 40-50% are qualified. You have 2-3 prospects.

- Close rate: 2-5% for cold leads. You close 0-1 sales.

- Commission: $10,000 per $100,000 sale. Total: $0-$10,000.

Result: You spent $6,000 to make $0-$10,000. If you close one sale, you net $4,000. But you invested 50+ hours. Your true cost-per-sale: $6,000-$25,000.

The Referral Illusion

Referrals work, but they're not scalable. You can't control when they come. You can't optimize them. You can't predict ROI. Relying on referrals means your income depends on clients' memory and motivation. Most advisors get 2-5 referrals per year. That's not a system. That's hope.

The Social Media Time Sink

Posting on LinkedIn or Facebook doesn't find annuity clients. It generates likes. Without a clear funnel, specific offer, and conversion tracking, social media is digital billboard advertising—expensive and unmeasurable. You're creating content and hoping something happens. Hope isn't a strategy.

The Seminar Reality Check

Seminars work, but they're expensive and time-consuming. You spend $2,000-$5,000 on venue, food, and marketing. You spend 20-30 hours preparing and presenting. You get 30-50 attendees. You close 10-20%. That's 3-10 sales. Your cost-per-sale: $200-$1,667. But you can't scale it. You can only run so many seminars per month.

Why Annuity Clients Are Different (And Why It Matters)

Annuity clients aren't like life insurance clients. Understanding this difference explains why traditional methods fail.

The Education Requirement

A life insurance sale can happen in one call. The product is simple: you die, they get paid. An annuity sale requires education because you're asking someone to move significant retirement savings into a complex product with multiple variables:

- Fixed vs. variable vs. indexed structures

- Surrender charges and liquidity restrictions

- Tax implications and 1035 exchanges

- Income riders and withdrawal strategies

- Market participation rates and caps

- How it fits their overall retirement plan

This education can't happen in a 15-minute cold call. It requires trust. And trust requires familiarity. A prospect who filled out a form doesn't know you. They're not ready to discuss moving $100,000+ of retirement savings.

The Buyer's Journey

Annuity sales follow a longer timeline:

- Awareness: Prospect learns about annuities

- Education: They understand how different types work

- Consideration: They evaluate if an annuity fits their plan

- Trust building: They develop confidence in you

- Decision: They move forward with purchase

When you buy a lead, you're jumping into step 4 or 5 with someone at step 1 or 2. You're trying to close before you've educated. This is why your close rate is 2-5% instead of 15-25%.

The Capital Commitment

Annuities require significant capital. A prospect isn't moving $50,000-$500,000+ without understanding the product, trusting you, and feeling confident in the decision. A cold lead hasn't built any of these. You're asking them to make a major financial decision based on a 15-minute phone call with someone they don't know.

The Branded Lead System: How Top Producers Find Annuity Clients

Top producers don't buy leads or rely on referrals. They build systems that generate branded leads—prospects who have consumed 10-15 pieces of educational content before you ever speak.

What Is a Branded Annuity Lead?

A branded lead isn't just someone who saw your ad. It's someone who has:

- Watched 10-15 short videos explaining annuity concepts

- Learned about fixed vs. variable vs. indexed annuities

- Understood surrender charges, liquidity, and tax implications

- Seen case studies of how annuities solved specific retirement problems

- Developed trust in you as an educator and advisor

- Pre-qualified themselves by engaging with your content consistently

By the time they book an appointment, they're not a cold prospect. They're a warm lead who already understands annuities and trusts you as an advisor. This eliminates the education gap that kills traditional lead conversion.

The Math That Makes Branded Leads Profitable

Compare branded lead generation to traditional methods:

Buying Cold Leads:

- Cost: $300 per lead

- Contact rate: 30%

- Education time: 40 minutes per prospect

- Close rate: 3%

- Cost per sale: $10,000

- Time per sale: 50+ hours

Branded Lead Generation:

- Cost: $50-$100 per lead (ad spend)

- Contact rate: 80%+ (they booked)

- Education time: 5 minutes (pre-educated)

- Close rate: 15-25%

- Cost per sale: $200-$667

- Time per sale: 6-10 hours

Branded leads cost 80-97% less per sale, convert 5-12x higher, and require 80% less time. The system builds your brand and creates long-term value. Every dollar spent compounds over time.

How to Find Annuity Clients: The Complete Blueprint

Step 1: Create Education-First Content That Builds Trust

Your content strategy must focus on teaching, not selling. Use our Free Agent Ad Scripts as a starting point, but adapt them specifically for annuity education.

Content Pillars for Annuity Marketing:

- Annuity Basics: "What is a fixed annuity and when does it make sense?"

- Product Education: "Fixed vs. Variable vs. Indexed Annuities: Which is Right for You?"

- Common Mistakes: "The 5 Biggest Annuity Mistakes Retirees Make (And How to Avoid Them)"

- Case Studies: "How a Fixed Index Annuity Protected This Couple's Retirement from Market Volatility"

- Retirement Planning: "How Annuities Fit Into Your Overall Retirement Strategy"

- Tax Strategies: "Tax-Deferred Growth vs. Tax-Free Withdrawals: Understanding Annuity Tax Benefits"

- Income Planning: "Guaranteed Lifetime Income: How Annuity Income Riders Work"

Each piece should answer a specific question your ideal client has. Film these as 15-30 second videos. You don't need a studio—a smartphone, good lighting, and a simple background are enough. The goal is education, not production value.

The Content Consumption Funnel:

- Awareness (videos 1-5): Basic annuity education, problem identification

- Consideration (videos 6-10): Product comparisons, case studies, how-to guides

- Decision (videos 11-15): Social proof, urgency, next steps, appointment booking

By the time prospects reach video 10-15, they've self-qualified by engaging consistently. They understand annuities. They trust you. They're ready to book.

Step 2: Target Pre-Retirement Demographics with Precision

While traditional methods use broad lists, you can target with precision using Facebook, LinkedIn, and Google ads.

Primary Targeting:

- Age: 45-65 (pre-retirement and early retirement)

- Income: $75,000+ household income

- Assets: $100,000+ in retirement savings (behavioral targeting)

- Location: High net worth zip codes, retirement communities

Interest and Behavioral Targeting:

- Retirement planning content engagement

- Financial security interests

- Investment education engagement

- Visited retirement planning websites

- Searched for annuity information

- Engaged with financial advisor content

Lookalike Audiences: Create lookalike audiences from your existing clients, email list, or website visitors. These audiences match your best customers and convert 2-3x higher than interest-based targeting.

Layering Targeting Options: Combine multiple targeting layers. For example: Age 50-65 + Income $100,000+ + Interest in retirement planning + Visited annuity websites + Lives in high net worth zip code.

Step 3: Build a Conversion Funnel That Educates Continuously

Your landing page shouldn't just capture contact information. It should continue the education process.

The Funnel Structure:

-

The Offer: "Get Your Free Retirement Income Analysis" or "Download: The Complete Guide to Fixed vs. Variable Annuities"

-

The Value Delivery: Provide actionable information:

- Comprehensive PDF guide

- Video series on annuity basics

- Retirement income calculator

- Case study library

-

The Automation: Send educational emails over 7-14 days:

- Day 1: Welcome email with requested resource

- Day 3: Educational content about annuity types

- Day 5: Case study or success story

- Day 7: Invitation to book consultation

- Day 10: Follow-up with additional value (market update, tax tip)

- Day 14: Final invitation with social proof and urgency

This positions you as an advisor, not a salesperson. By the time they book, they're already sold on your expertise.

Step 4: Optimize for Show Rate and Close Rate

The branded lead system improves both metrics simultaneously.

Show Rate Optimization:

- Prospects know you before the appointment (80%+ show rates vs. 35-45% for cold leads)

- They've engaged with your content 10-15 times

- They understand the value you provide

- They've self-qualified by booking

Close Rate Optimization:

- Prospects arrive educated about annuities (15-25% close rates vs. 2-5% for cold leads)

- Trust is established through content consumption

- Objections are pre-handled in your educational content

- They see you as an advisor, not a salesperson

The combination of high show rates and high close rates creates exponential ROI improvements.

Step 5: Leverage Existing Clients for Upsells and Referrals

Your existing annuity clients are a goldmine you're probably ignoring.

Annuity Review Process:

Many clients have annuities purchased years ago that no longer fit their needs. Offer a free annuity review:

- Review their current contracts

- Compare to today's products and rates

- Identify opportunities for increased income (often 10-30% more)

- Present solutions that better fit their goals

This process:

- Increases income for existing clients (building loyalty)

- Uncovers opportunities for additional purchases

- Generates referrals when clients see increased value

- Positions you as a proactive advisor

Referral System:

Don't just ask for referrals. Create a system:

- Identify your ideal client profile: Who are your best clients? Document their characteristics.

- Ask targeted questions: "Do you know anyone in your network who's nearing retirement and concerned about outliving their savings?"

- Make introductions easy: Ask satisfied clients to make warm introductions

- Provide value first: Offer free resources to referred prospects before asking for appointments

This systematic approach generates 3-5x more referrals than generic "do you know anyone" requests.

Advanced Tactics: What Top 1% Producers Do Differently

Multi-Channel Content Distribution

Top producers don't rely on one platform. They distribute content across:

- Facebook: Broad reach, cost-effective targeting

- LinkedIn: Professional audience, higher income demographics

- YouTube: Long-form education, SEO benefits

- Google Ads: High-intent search traffic

- Email sequences: Nurturing and retargeting

This multi-channel approach ensures prospects see your content consistently, building familiarity and trust faster.

Retargeting Sequences

Not everyone books after the first interaction. Set up retargeting campaigns for:

- Website visitors who didn't convert

- Video viewers who watched but didn't book

- Email subscribers who haven't scheduled

- Landing page visitors who abandoned forms

Retargeting captures prospects who need more time or education, significantly improving overall conversion rates.

A/B Testing and Optimization

Top producers test everything:

- Ad creative (images, video thumbnails, headlines)

- Ad copy (benefits vs. features, questions vs. statements)

- Landing page design (single column vs. two column, video vs. form)

- Email sequences (subject lines, send times, content length)

- Offer positioning (free consultation vs. free guide vs. free analysis)

Continuous testing improves results over time. What starts at $100 cost-per-lead can drop to $50-$75 as you optimize.

Social Proof Integration

Include testimonials, case studies, and success stories throughout your funnel:

- In video ads (quick testimonial clips)

- On landing pages (client success stories)

- In email sequences (results your clients achieved)

- During consultations (real examples of solutions)

Social proof builds trust and reduces objections before prospects even speak with you.

The Two Paths Forward: Build or Buy (The Right Way)

You have two options to find annuity clients:

Path 1: Build Your Own System

This requires investment in learning but gives you a permanent asset. You'll master:

- Content creation and video production

- Paid advertising on Facebook, LinkedIn, and Google

- Funnel construction and automation

- Email and SMS sequences

- Analytics and optimization

For agents serious about learning to run your own ads, our S.C.A.L.E. course provides the complete blueprint for building annuity client acquisition systems that work long-term.

Timeline: 60-90 days to see consistent results, but the system compounds over time.

Investment: $2,000-$5,000 for training + $3,000-$8,000 monthly ad spend

Return: 10-50+ leads per month at $50-$100 each with 15-25% close rates

Path 2: Done-For-You Branded Leads

If you need annuity appointments now and have capital to invest, a done-for-you service builds and manages the entire system. You receive exclusive, warm appointments with prospects who already know and trust you.

What you get:

- Complete branded video ad system

- Automated educational sequences

- Landing pages and conversion funnels

- Lead nurturing and appointment booking

- Ongoing optimization and management

Explore our branded leads service to see how this works in practice.

Timeline: 30-45 days to first appointments

Investment: $3,000-$8,000 monthly (includes ad spend and management)

Return: 10-30+ exclusive appointments per month with 80%+ show rates and 15-25% close rates

Both paths are superior to buying cold leads because they build assets that compound over time. You're not renting clients—you're owning your acquisition system.

The Bottom Line: Stop Renting, Start Finding

The methods dominating the SERP for finding annuity clients are outdated and expensive. Buying cold leads costs $5,000-$25,000 per sale. Relying on referrals isn't scalable. Posting on social media without a system is hope, not strategy.

Finding annuity clients requires trust, education, and relationship-building. These can't be bought in a lead list. They must be built through consistent, valuable content that positions you as the expert your prospects need.

The future belongs to advisors who generate their own clients through branded systems, not those who rent them from vendors. The math is clear: branded lead generation delivers 5-12x better ROI, higher close rates, and builds a scalable asset that compounds over time.

Stop buying leads. Stop hoping for referrals. Start building your system. Your future self will thank you.