IMO Insurance Companies: The Real Truth

You're researching IMO insurance companies. You've read the articles. They all say the same thing: "IMOs provide access to carriers and support." They don't tell you the real numbers. They don't show you the math. They don't explain why some agents make six figures with IMOs while others struggle. Here's what they're hiding.

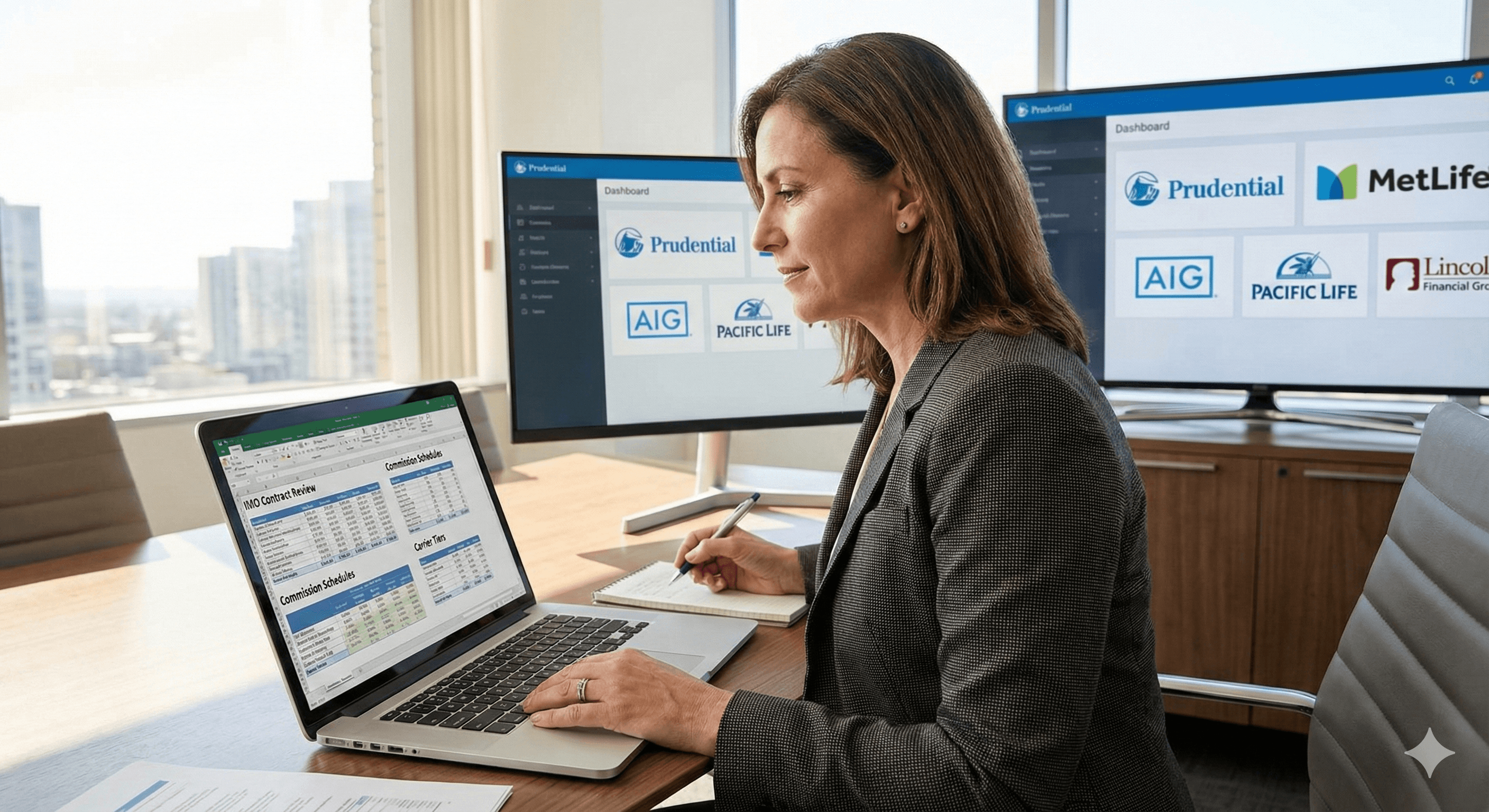

IMO insurance companies are organizations that connect independent insurance agents with multiple carriers. They negotiate higher commission rates, provide training and marketing support, and handle back-office tasks. The best IMOs act as true partners, helping agents scale their business while maintaining independence. The worst IMOs are just contract mills that take overrides without providing value.

The IMO you choose determines your income potential. Choose wisely.

What IMO Insurance Companies Actually Do: The Real Breakdown

Most articles explain IMOs in vague terms. Here's the real breakdown:

The IMO Business Model: How They Make Money

The Process:

- IMOs contract directly with insurance carriers

- They negotiate higher commission tiers based on aggregate production

- They contract agents underneath them

- Agents sell policies through the IMO

- Carriers pay commissions to the IMO

- IMO keeps a 2-10% override and passes the rest to agents

The Math:

- Agent sells a policy with $1,000 commission

- Carrier pays IMO $1,000

- IMO keeps $20-$100 (2-10% override)

- Agent receives $900-$980 (90-98% of commission)

Why This Works: Agents get higher commission rates than going direct. IMOs aggregate production to reach higher tiers. Everyone wins. The agent makes more. The IMO makes money. The carrier gets production without direct agent management.

What IMOs Actually Provide: The Value Stack

1. Higher Commission Rates

- Direct contracts: 50-70% commission

- IMO contracts: 70-120% commission (depending on product and volume)

- Difference: 20-50% more income per sale

2. Carrier Access

- Direct contracts require $500K-$2M annual production

- IMO contracts: No minimums (or low minimums)

- Access to 20-100+ carriers through one relationship

3. Training and Support

- Product training (new products, underwriting, sales systems)

- Marketing support (materials, campaigns, lead generation)

- Back-office support (contracting, compliance, case management)

- Technology tools (CRM, quoting systems, enrollment platforms)

4. Business Development

- Recruiting support (if building a team)

- Conference access (industry events, carrier meetings)

- Networking opportunities (other agents, carrier reps)

The value varies by IMO. Some provide comprehensive support. Others provide minimal support. The difference determines whether you thrive or struggle.

The IMO vs Direct Contract Math: Why IMOs Win for Most Agents

Most agents think going direct is better. Here's why it's not:

Direct Contract Requirements

The Reality:

- Minimum production: $500K-$2M annually

- Limited carrier access (1-3 carriers)

- Minimal support (you're on your own)

- Lower commission rates (unless you're a top producer)

The Math:

- You need 50-200 sales per year to maintain direct contracts

- You handle all training, marketing, and back-office tasks

- You're locked into specific carriers

- You earn 50-70% commission

Who This Works For: Top producers with established books of business. Agents who want to be carriers' direct partners. Agencies with large teams and infrastructure.

IMO Contract Benefits

The Reality:

- No minimum production (or low minimums)

- Access to 20-100+ carriers

- Comprehensive support (training, marketing, back-office)

- Higher commission rates (70-120%)

The Math:

- You can start with 0 sales and build

- IMO handles training, marketing, and back-office tasks

- You choose from multiple carriers per client

- You earn 70-120% commission

Who This Works For: New agents building their business. Experienced agents wanting more carrier options. Agents who want support without being captive.

The Real Comparison

Direct Contract:

- Commission: 50-70%

- Support: Minimal

- Carriers: 1-3

- Requirements: $500K-$2M production

- Best for: Top producers with infrastructure

IMO Contract:

- Commission: 70-120%

- Support: Comprehensive

- Carriers: 20-100+

- Requirements: Low or none

- Best for: Most independent agents

The math is clear. IMOs win for most agents.

How to Choose the Right IMO: The Evaluation Framework

Most agents choose IMOs based on commission rates alone. That's a mistake. Here's the real framework:

Factor 1: Commission Structure

What to Look For:

- Base commission rates (70-120% depending on product)

- Volume bonuses (higher rates at production milestones)

- Renewal commissions (do you keep renewals if you leave?)

- Contract transparency (clear commission schedule)

Red Flags:

- Vague commission structures

- Promises of "highest rates" without specifics

- No renewal protection

- Hidden fees or charges

The Math: Compare commission rates across 3-5 IMOs for your primary products. A 5% difference in commission equals $50 per $1,000 of premium. Over 100 sales per year, that's $5,000 in additional income.

Factor 2: Carrier Access

What to Look For:

- Number of carriers (20-100+ is standard)

- Quality of carriers (A-rated, competitive products)

- Product diversity (life, health, Medicare, annuities)

- Carrier relationships (are they top-tier or bottom-tier contracts?)

Red Flags:

- Limited carrier access (fewer than 10 carriers)

- Only low-tier carriers

- No access to top carriers in your niche

- Carriers with poor ratings or reputation

The Math: More carriers mean more options per client. More options mean higher close rates. If you can only offer 2-3 carriers, you lose clients who need different products. If you can offer 10-20 carriers, you close more sales.

Factor 3: Training and Support

What to Look For:

- Product training (regular updates, new product launches)

- Sales training (scripts, systems, best practices)

- Marketing support (materials, campaigns, lead generation)

- Back-office support (contracting, compliance, case management)

- Technology tools (CRM, quoting, enrollment platforms)

Red Flags:

- Minimal training (one-time onboarding only)

- No marketing support

- Weak back-office support

- Outdated technology

The Math: Good training increases your close rate by 10-20%. Good marketing support reduces your lead costs by 30-50%. Good back-office support saves you 5-10 hours per week. The value is real.

Factor 4: Reputation and References

What to Look For:

- Agent testimonials (what do current agents say?)

- Carrier relationships (do carriers respect the IMO?)

- Industry recognition (awards, conference presence)

- Years in business (established IMOs are more stable)

Red Flags:

- Negative reviews from agents

- Poor carrier relationships

- New IMO with no track record

- No references or testimonials

The Math: Reputation matters. IMOs with good reputations attract better agents. Better agents mean better support and resources. Better support means you make more money.

Factor 5: Contract Terms

What to Look For:

- Release clauses (can you leave if unhappy?)

- Renewal protection (do you keep renewals?)

- Non-compete clauses (are they reasonable?)

- Commission protection (are rates locked in?)

Red Flags:

- No release clause

- Lose renewals if you leave

- Unreasonable non-compete

- Commission rates can change without notice

The Math: Bad contract terms cost you money. If you can't leave when unhappy, you're trapped. If you lose renewals when leaving, you lose future income. If commission rates can change, you lose stability.

The IMO vs FMO vs MGA Confusion: What Actually Matters

The industry uses these terms interchangeably. Here's the real breakdown:

IMO (Independent Marketing Organization)

Focus: Life insurance and annuities Structure: Top-level organization with carrier contracts Agents: Contracts individual agents and agencies Support: Comprehensive (training, marketing, back-office)

FMO (Field Marketing Organization)

Focus: Medicare and health insurance (traditionally) Structure: Similar to IMO, often broader product mix Agents: Contracts individual agents and agencies Support: Comprehensive (training, marketing, back-office)

The Reality: IMO and FMO are often the same thing. Many organizations use both terms. The difference is historical, not functional. Focus on what they offer, not the acronym.

MGA (Managing General Agent)

Focus: Varies (life, health, or both) Structure: One level below IMO/FMO Agents: Manages a team of agents Support: Varies (some comprehensive, some minimal)

The Reality: MGAs often contract under IMOs/FMOs. They provide an additional layer between agents and carriers. They earn overrides on their downline agents' production.

What Actually Matters

Don't Focus On:

- The acronym (IMO vs FMO vs MGA)

- Historical definitions

- Industry jargon

Do Focus On:

- Commission rates

- Carrier access

- Training quality

- Marketing support

- Back-office support

- Contract terms

- Reputation

The acronym doesn't matter. The value does.

Common IMO Mistakes That Cost Agents Money

Most agents make these mistakes when choosing IMOs:

Mistake 1: Choosing Based on Commission Alone

The Problem: You see an IMO offering 120% commission. You sign up. You realize they provide no training, weak marketing support, and limited carriers. You make less money despite higher rates.

The Solution: Evaluate the full value stack. Commission matters, but support matters more. A 5% lower commission with great support beats a 5% higher commission with no support.

Mistake 2: Not Checking References

The Problem: You sign with an IMO based on their website. You don't talk to current agents. You don't check reviews. You discover they have a bad reputation and poor support.

The Solution: Talk to 3-5 current agents before signing. Ask about support quality, commission payments, and overall satisfaction. Check online reviews and industry forums.

Mistake 3: Ignoring Contract Terms

The Problem: You sign a contract without reading it carefully. You discover you can't leave without losing renewals. You're trapped with a bad IMO.

The Solution: Read the contract carefully. Understand release clauses, renewal protection, and non-compete terms. Have a lawyer review it if needed.

Mistake 4: Not Evaluating Support Quality

The Problem: You assume all IMOs provide the same support. You discover your IMO provides minimal training, weak marketing, and slow back-office support.

The Solution: Ask specific questions about support. Request examples of training materials, marketing campaigns, and technology tools. Test their responsiveness before signing.

Mistake 5: Switching IMOs Too Often

The Problem: You switch IMOs every 6-12 months chasing higher commissions. You lose renewals, disrupt relationships, and waste time on onboarding.

The Solution: Choose carefully the first time. Build relationships with carriers and IMO staff. Only switch if there's a significant problem or better opportunity.

The Bottom Line: IMOs Are Tools, Not Solutions

IMOs are tools that help you access carriers and support. They're not magic solutions that make you successful. Success comes from:

- Choosing the Right IMO: One that provides real value, not just contracts

- Using IMO Resources: Training, marketing, and support actually work

- Generating Quality Leads: IMOs don't generate leads for you (usually)

- Closing Sales: IMOs provide tools, but you still need to sell

The Real Truth: The best IMO in the world won't help if you don't have leads. The worst IMO won't hurt if you have great leads and strong sales skills. IMOs are amplifiers. They make good agents better. They don't make bad agents good.

The Math:

- Great IMO + Great Leads + Great Sales Skills = Success

- Great IMO + Bad Leads + Bad Sales Skills = Failure

- Bad IMO + Great Leads + Great Sales Skills = Success (with more work)

Focus on leads and sales skills first. Then choose an IMO that amplifies your success.

If you're ready to generate quality leads that convert, explore our branded lead system to see how top agents build consistent pipelines. Or get our free ad scripts to start creating your own leads today.

The IMO you choose matters. But the leads you generate matter more. Focus on what actually drives revenue.