Life Leads: The Real Numbers Behind Why Most Agents Lose Money (And What Actually Works)

Every month, thousands of life insurance agents spend $2,000 to $10,000 buying life leads. Most lose money. The vendors profit. The agents burn out. Here's the brutal math that explains why, and the system that actually converts.

Life leads are contact information for prospects who have requested life insurance quotes from lead generation companies. These leads are typically shared with 3-8 other agents, creating immediate competition. While real-time life leads cost $30-$50 each and aged leads cost $5-$15, the hidden costs—low contact rates (30-40%), lower close rates (2-5%), and zero ownership—make this model financially unsustainable for most agents, resulting in $500-$2,000 cost per sale when commissions average $300-$600 per policy.

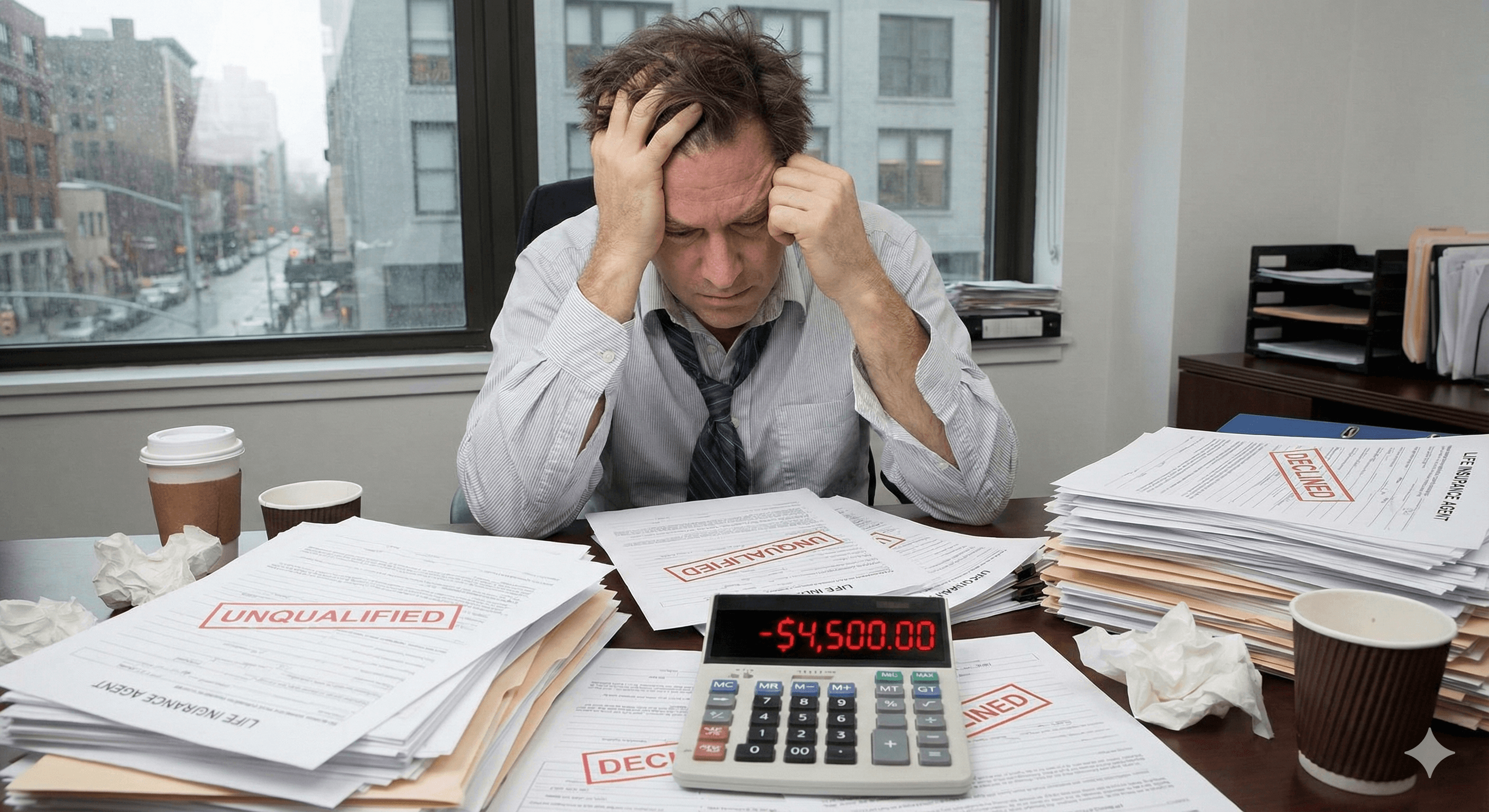

The real cost of buying life leads isn't the price tag—it's the math that doesn't add up.

The Life Lead Math: Why Most Agents Lose Money

Let's break down what actually happens when you buy life insurance leads.

The Real-Time Life Lead Trap

You buy 100 real-time life insurance leads at $35 each. Total investment: $3,500.

What happens next:

- Contact Rate: 30-40% of leads answer or respond. You reach 35 people.

- Qualification Rate: Half of those aren't qualified, can't afford coverage, or already bought. You have 18 qualified prospects.

- Close Rate: Industry average for purchased life leads is 2-5%. You close 2-3 sales.

- Commission: At 50% commission on a $200/month whole life policy, you make $600 per sale. Total: $1,200-$1,800.

Result: You spent $3,500 to make $1,200-$1,800. You lost $1,700-$2,300. And that's if you're a decent closer.

The Aged Life Lead Illusion

Aged life leads cost less ($5-$15), so the math must be better, right? Wrong.

You buy 500 aged life leads at $10 each. Total investment: $5,000.

The reality:

- Contact Rate: 20-30% (lower because leads are older). You reach 125 people.

- Qualification Rate: 40% are still interested. You have 50 qualified prospects.

- Close Rate: 1-3% (lower than real-time). You close 5-15 sales.

- Commission: Same $600 per sale. Total: $3,000-$9,000.

Result: You might break even or make a small profit, but you're working 5x harder for the same or worse results. You're also competing with agents who bought the same leads weeks or months ago.

The Final Expense Lead Math

Final expense leads (ages 50-80, max $25k policy) cost $20-$35 each. The math looks different, but the problem is the same.

You buy 200 final expense leads at $25 each. Total investment: $5,000.

The reality:

- Contact Rate: 35-45% (slightly higher for older demographics). You reach 80 people.

- Qualification Rate: 50% are qualified. You have 40 qualified prospects.

- Close Rate: 3-7% (slightly higher than term/whole life). You close 6-14 sales.

- Commission: At $300-$400 per sale (lower premiums = lower commissions). Total: $1,800-$5,600.

Result: You might make a small profit, but you're still working harder than necessary. The commissions are lower, so even with better close rates, your effective hourly rate is still poor.

The Hidden Costs Nobody Talks About

The price per lead is just the beginning. Add these hidden costs:

- Time Investment: 2-3 hours per day calling, following up, and managing CRM entries

- Emotional Drain: Constant rejection from cold prospects who don't know you

- Opportunity Cost: Time spent chasing shared leads instead of building your own system

- No Ownership: Every dollar spent is gone. You're renting, not building an asset

- Carrier Restrictions: Many carriers won't accept leads from certain vendors, limiting your options

The vendors know this math. That's why they sell the same leads to multiple agents. Their business model depends on agents losing money.

Why Life Leads Are Different (And Harder)

Life insurance leads have unique challenges that make them even harder to convert than other insurance leads.

The Emotional Barrier

Unlike auto or home insurance (which people need immediately), life insurance is an emotional purchase people delay. A prospect who requested a quote last week might have:

- Changed their mind

- Decided to "think about it" (forever)

- Found a cheaper option

- Been scared off by the medical exam requirement

- Decided they don't need it after all

By the time you call, the urgency is gone.

The Medical Qualification Problem

Life insurance requires medical underwriting. A "qualified" lead doesn't mean they'll qualify for coverage. They might have:

- Pre-existing conditions that make them uninsurable

- Health issues that increase premiums beyond their budget

- Medications that disqualify them from preferred rates

- Lifestyle factors (smoking, dangerous hobbies) that affect pricing

You can't know this until you've invested time in the application process.

The Competition Multiplier

Life leads are shared with 3-8 agents. But here's what makes it worse:

- Multiple agents call the same day

- The prospect gets annoyed and stops answering

- They book with whoever calls first (not necessarily you)

- They compare quotes and go with the cheapest (not the best agent)

You're not just competing with other agents. You're competing with their annoyance level.

The Commission Structure Reality

Life insurance commissions are front-loaded but spread over years. A $200/month whole life policy might pay:

- Year 1: $600 commission

- Year 2: $300 commission

- Year 3-10: $100-$200 per year

If the client cancels in year 2, you lose the future commissions. Most agents don't factor this into their lead ROI calculations.

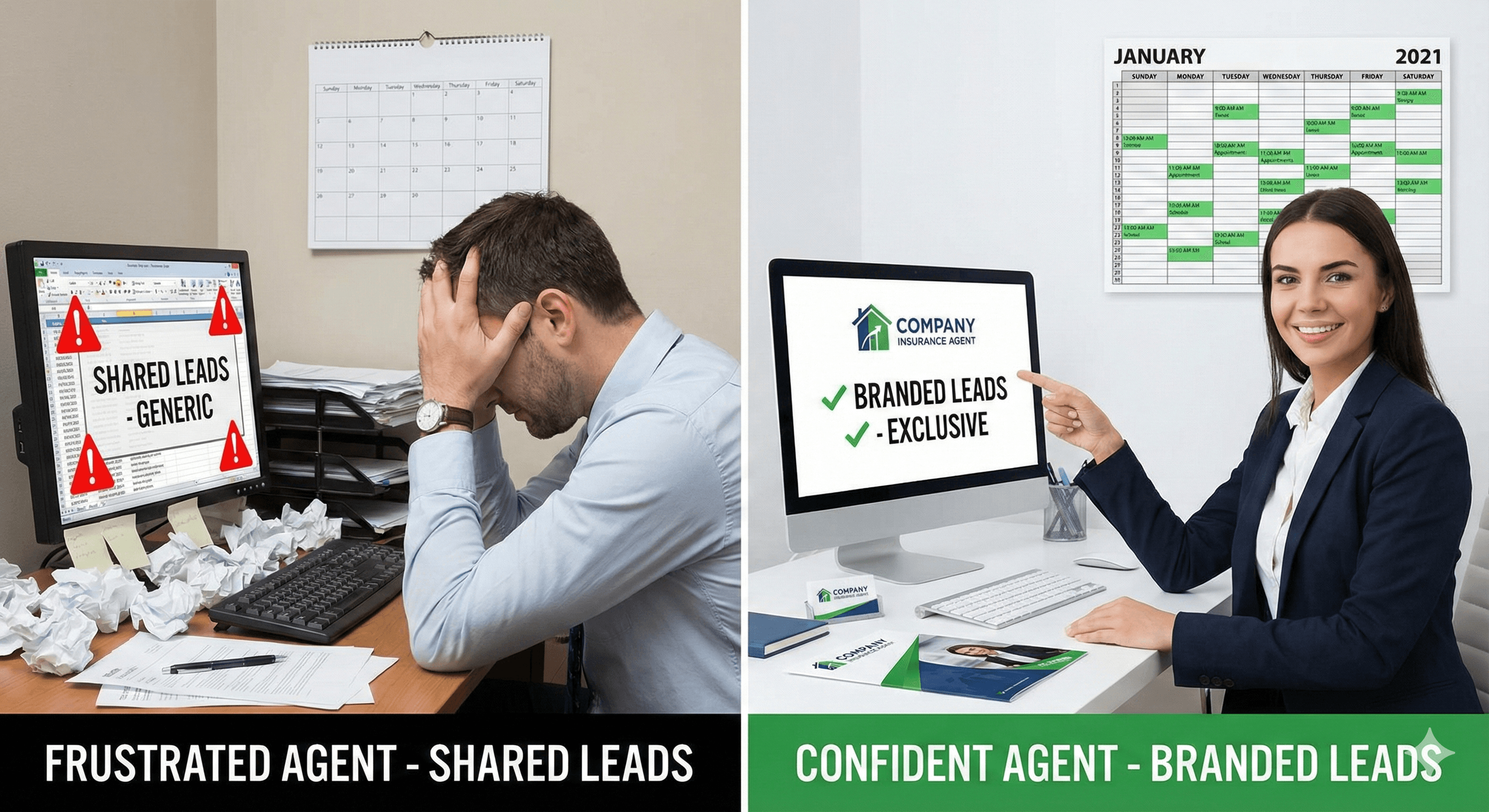

The System That Actually Works: Branded Life Leads

Top life insurance producers don't buy leads. They build systems that generate branded life leads—prospects who know, like, and trust them before the first call.

What Is a Branded Life Lead?

A branded life lead is a prospect who has:

- Seen your face in 10-15 short video ads about life insurance topics

- Heard your voice explaining concepts like term vs whole life, final expense, or IUL

- Consumed your content and learned from you

- Requested to speak with you specifically about their life insurance needs

They're not cold. They're not shared. They're warm, qualified, and pre-sold on you.

The Branded Life Lead Math

Instead of buying 100 shared life leads for $3,500, you invest in a system that generates 20 branded life leads per month.

What happens:

- Contact Rate: 80-90% (they requested to speak with you). You reach 18 people.

- Qualification Rate: 70-80% (they've already consumed your content). You have 14 qualified prospects.

- Close Rate: 15-25% (they know and trust you). You close 3-4 sales.

- Commission: Same $600 per sale. Total: $1,800-$2,400.

Result: You spent less, worked less, and made more. Plus, you own the system. It keeps working.

How Branded Life Leads Work

The system has three components:

1. Micro-Video Content for Life Insurance

You create 15-30 second video ads that educate prospects on specific life insurance topics:

- "Why your term life insurance policy might expire before you do"

- "The hidden cost of not having mortgage protection insurance"

- "How to pass wealth to your kids without probate"

- "Why final expense insurance is different from whole life"

- "The IUL strategy most agents don't want you to know"

These aren't sales pitches. They're value-first education that positions you as the life insurance expert. Prospects watch multiple videos, building familiarity and trust.

You don't need a studio. You need a smartphone and proven scripts. Our Free Agent Ad Scripts give you the exact frameworks to get started.

2. The Life Insurance Funnel

Your video ads drive traffic to a landing page that:

- Mirrors the promise of your ad

- Offers high-value content (free policy review, life insurance calculator, final expense guide)

- Captures contact information in exchange for the offer

- Automatically books qualified prospects on your calendar

This entire process is automated. You're not manually entering leads or chasing prospects. They come to you.

3. The Nurture Sequence

Once a prospect enters your system, automated emails and texts:

- Pre-frame the sales conversation

- Answer common life insurance objections ("I'm too young," "It's too expensive," "I have coverage at work")

- Build additional trust

- Keep you top-of-mind

By the time you speak with them, they're not cold. They're consulting with someone they already trust about their life insurance needs.

The difference between renting life leads and owning your system.

Life Lead Types: What Actually Converts

Not all life leads are created equal. Here's what you need to know about each type:

Term Life Leads

What they are: Prospects seeking temporary coverage (10-30 years) for specific needs (mortgage protection, income replacement).

Typical cost: $25-$40 per lead

Conversion reality: 2-4% close rate. Lower premiums mean lower commissions ($300-$500 per sale). The math rarely works unless you're closing at scale.

Better approach: Create branded content around "term life mistakes" and "when term policies expire." Prospects who watch your content before booking close at 15-20% rates.

Whole Life Leads

What they are: Prospects seeking permanent coverage with cash value accumulation.

Typical cost: $30-$50 per lead

Conversion reality: 3-5% close rate. Higher premiums mean higher commissions ($600-$1,200 per sale), but the competition is fierce.

Better approach: Create branded content around "whole life vs term" and "cash value strategies." Educated prospects close at 20-25% rates.

Final Expense Leads

What they are: Prospects ages 50-80 seeking $5k-$25k policies to cover funeral expenses.

Typical cost: $20-$35 per lead

Conversion reality: 3-7% close rate. Lower commissions ($300-$400 per sale) but easier underwriting.

Better approach: Create branded content around "final expense mistakes" and "how to avoid burdening your family." Warm prospects close at 25-30% rates.

IUL Leads

What they are: Prospects interested in Indexed Universal Life for wealth accumulation and tax advantages.

Typical cost: $35-$50 per lead

Conversion reality: 2-4% close rate. Complex product requires education, which shared leads don't provide.

Better approach: Create branded content around "IUL strategies" and "tax-free retirement planning." Educated prospects close at 20-25% rates.

The pattern is clear: every life lead type converts better when prospects are pre-educated through branded content.

The Two Paths Forward

You have two options to escape the life lead-buying trap:

Path 1: Build It Yourself

Learn the complete system: ad creation, platform management, funnel building, and automation. This requires 3-6 months of focused learning and implementation, but you gain a skill that pays for decades.

Our S.C.A.L.E. course teaches you everything: video ad creation, Facebook and TikTok advertising, landing page optimization, CRM automation, and conversion optimization. It's the blueprint for building a sustainable, scalable life insurance lead system.

Best for: Agents who want long-term independence and are willing to invest time upfront.

Path 2: Done-For-You Service

We build and manage the entire system for you. You get:

- Custom video ads created and running (life insurance specific)

- Landing pages optimized for conversion

- Automated nurture sequences

- Exclusive, branded life insurance appointments delivered to your calendar

You focus on closing. We handle the system.

Best for: Agents who need results now and have capital to invest in a proven system.

Explore our Instant Leads service to see how we generate exclusive, pre-branded life insurance appointments for agents.

The Decision Framework

Before you spend another dollar on life leads, ask yourself:

- What's my actual cost per sale? Include the price per lead, your time, and your close rate. Most agents find it's $500-$2,000 per sale.

- Am I building an asset or renting? Every dollar spent on buying life leads is gone. Every dollar invested in your own system compounds.

- What's my long-term plan? If you plan to be in this business for 5+ years, you need a system you own.

- Can I afford to learn? The upfront investment in learning is higher, but the lifetime ROI is 10-100x better.

The Bottom Line

Buying life leads is a broken model designed to profit vendors, not agents. The math doesn't work for most agents, and it never will because the model itself is flawed.

Life insurance is an emotional, complex purchase that requires trust and education. Shared leads don't provide either. Prospects need to know you, trust you, and understand why they need coverage before they'll buy.

The alternative isn't complicated: build a system that generates branded life leads. Prospects see your content, request to speak with you, and close at 3-5x higher rates. You own the system. It works 24/7. It compounds over time.

Stop renting your income. Start building an asset.

Whether you learn to build it yourself or use our done-for-you service, the path forward is clear: own your life insurance lead generation, or keep losing money to vendors who profit from your struggle.